kentucky sales tax on vehicles

2 Motor vehicles which are not subject to the motor vehicle usage tax established in KRS 138460 or the U-Drive-It tax established in KRS 138463 shall be. Of course you can also use this handy sales tax calculator to confirm your.

Kentucky Llc How To Start An Llc In Kentucky In 11 Steps 2022

Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple.

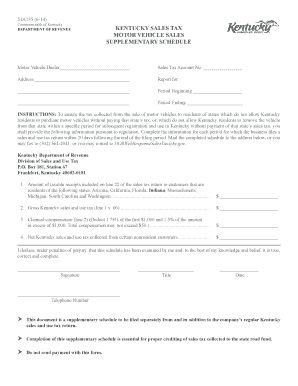

. Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67 Frankfort KY 40602-0181. Remote sellers are required to. Credit for Sales Tax Paid Out of State S8 - attach a copy of the receipt from the seller.

The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of. HB 487 effective July 1 2018 requires. Be subject to the sales or use tax.

783 Purpose of KRS 139780 to 139795. Equine Breeders 51A132 Remote Retailers. Kentucky does not charge any additional local or use tax.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all. Our free online Kentucky sales tax calculator calculates exact sales tax by state county city or ZIP code. A Sold to a Kentucky resident registered for use.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Title number OR license plate number. Uniform Sales and Use Tax Administration Act.

The state of Kentucky has a flat sales tax of 6 on car sales. 781 Definitions for KRS 139780 to 139795. Please note that special sales tax.

It is levied at six percent and shall be paid on every motor vehicle. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title. The property valuation for the average motor vehicle in Kentucky rose from 8006 to 11162 in just one year.

Aviation Fuel Dealers 51A131. How to Calculate Kentucky Sales Tax on a Car. This page describes the taxability of.

KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents 003 per kilowatt. Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle usage tax of 6 percent for every motor vehicle used in Kentucky. Motor Vehicle Usage Tax.

House Bill 380 Part 36-Sales of Motor Vehicles to Non-ResidentsSection 1. 600 US plus the cost of a notary. KRS139470 is amended to read as follows.

Sales Tax Paid to a Kentucky Vendor S9 - attach a copy of the receipt from the seller. Are services subject to sales tax in Kentucky. While Kentuckys sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

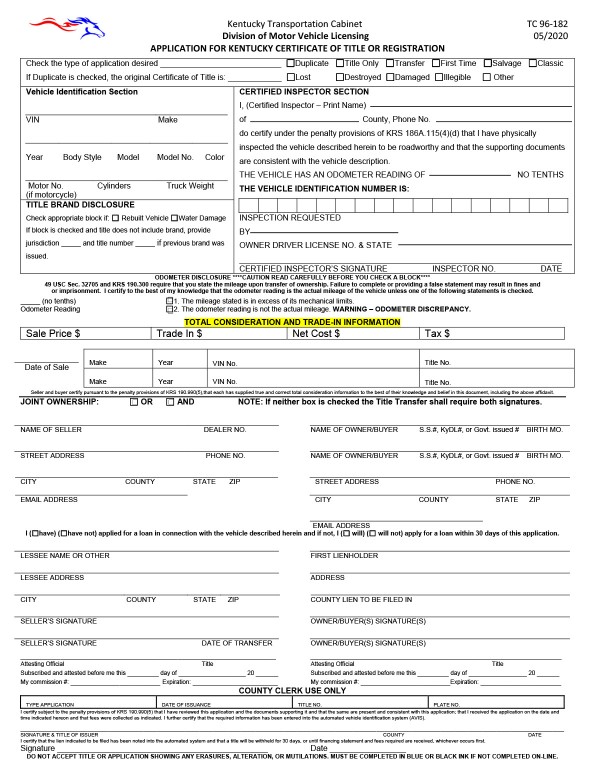

The Governor said the abrupt adjustment warrants a change and. Form TC96-182 properly completed including the owner and vehicle identification sections. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Do You Qualify For A Vehicle Sales Tax Deduction

Kentucky Ford Dealer Ford Cars Trucks Suvs In Stock

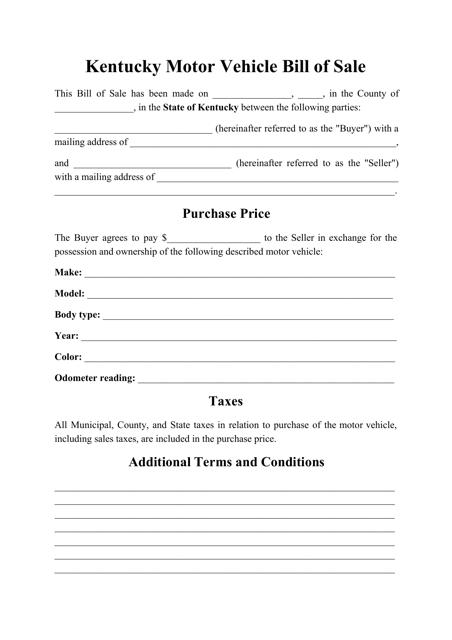

Kentucky Bill Of Sale Templates Save Time Editing Signing

Kentucky Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/X5G3K535SNDHPJLLFQ3XTR7YVM.jpg)

Wkyt Investigates Rising Car Taxes

Kentucky State Tax Guide Kiplinger

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Beshear Signs Executive Order To Freeze 2021 Vehicle Property Tax Rate For 2 Years News Wdrb Com

Kentucky Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

Beshear Proposes Sales Tax Decrease

Kentucky Lawmakers File Bills To Combat Rising Car Tax Whas11 Com

Wkyt Investigates Rising Car Taxes

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Motor Vehicle Bill Of Sale Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Kentucky Historic Motor Vehicle License Plate Ebay

Kentucky S Car Tax How Fair Is It Whas11 Com